GLOBAL LEDGER KYB SOLUTION

Generate comprehensive entity exposure reports for monthly, quarterly, or custom periods with all transactions and counterparties, including high-risk entities — all in one place.

VIEW WHO YOU’RE DEALING WITH

Verifiable Attribution

Get Instant, trusted evidence on 92K+ crypto entities — from exchanges to DeFi projects — to reduce risk and drive confident decisions.

Exposure Breakdown

Trace the source and use of funds for any entity, with a detailed breakdown of transactions to support confident, evidence-backed decisions.

Entity Intelligence

Access complete data on financial institutions, obscure VASPs, and DeFi projects — with risk insights to support your next compliance decisions.

Hidden Risk Detection

Uncover direct and indirect exposure to sanctioned entities, high-risk services, or suspicious sources to flag hidden threats early and take proactive action.

Evidence Toolkit

Leverage structured evidence and risk insights to confidently approve, reject, or escalate any counterparty case — even in complex scenarios.

Workflow Speed-Up

Streamline every step of due diligence with actionable insights — onboard with verified data, investigate with full context, and track changes to reassess risk.

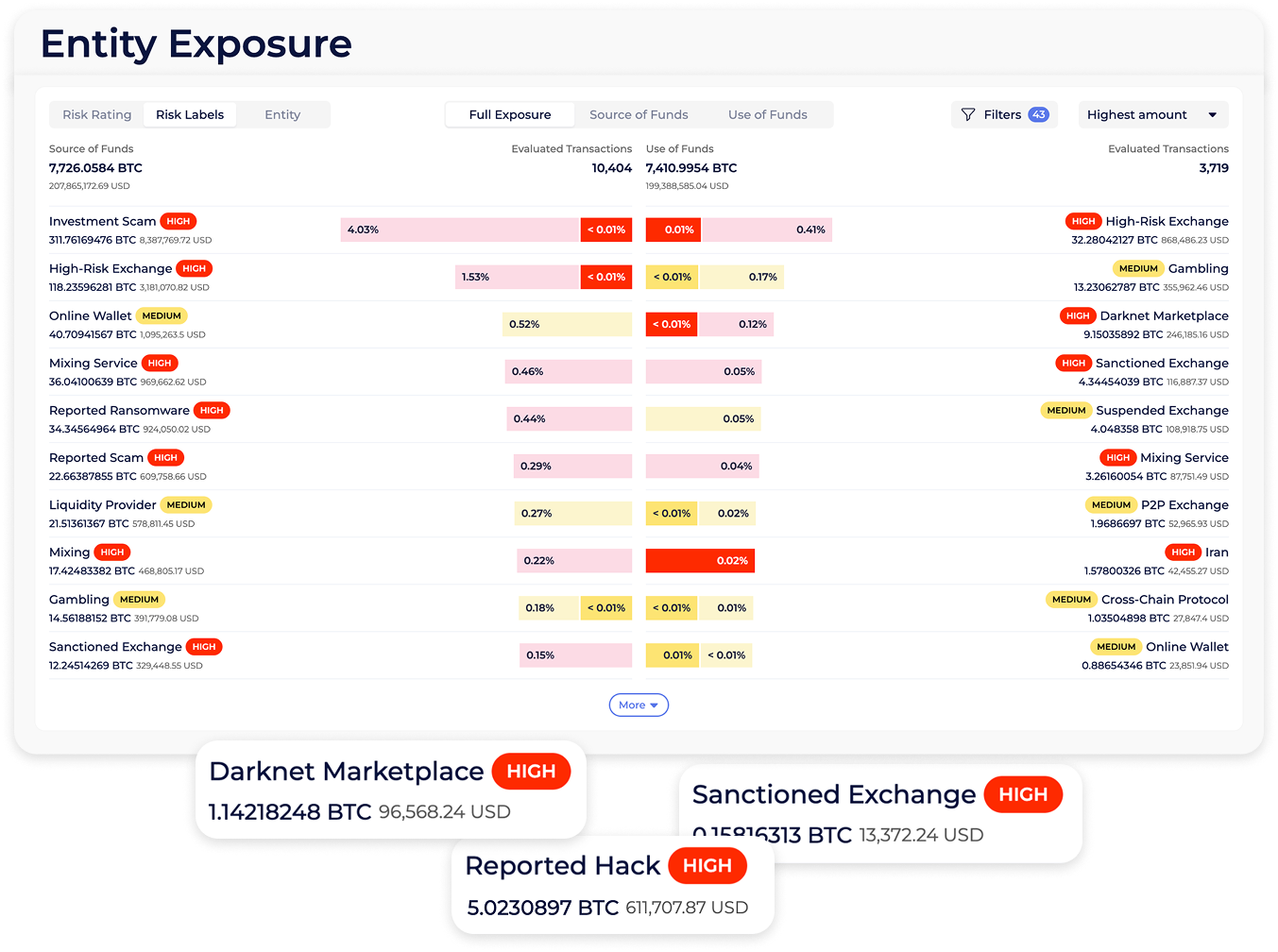

GENERATE ENTITY EXPOSURE REPORTS

Quickly assess what’s behind a counterparty’s activity to flag AML threats and exposure risks — all in one report:

- Check source and use of funds to spot suspicious flows by entities and risk labels.

- Identify counterparties by risk and volume to focus your due diligence.

- Analyze counterparty’s direct and indirect exposure to uncover hidden risks.

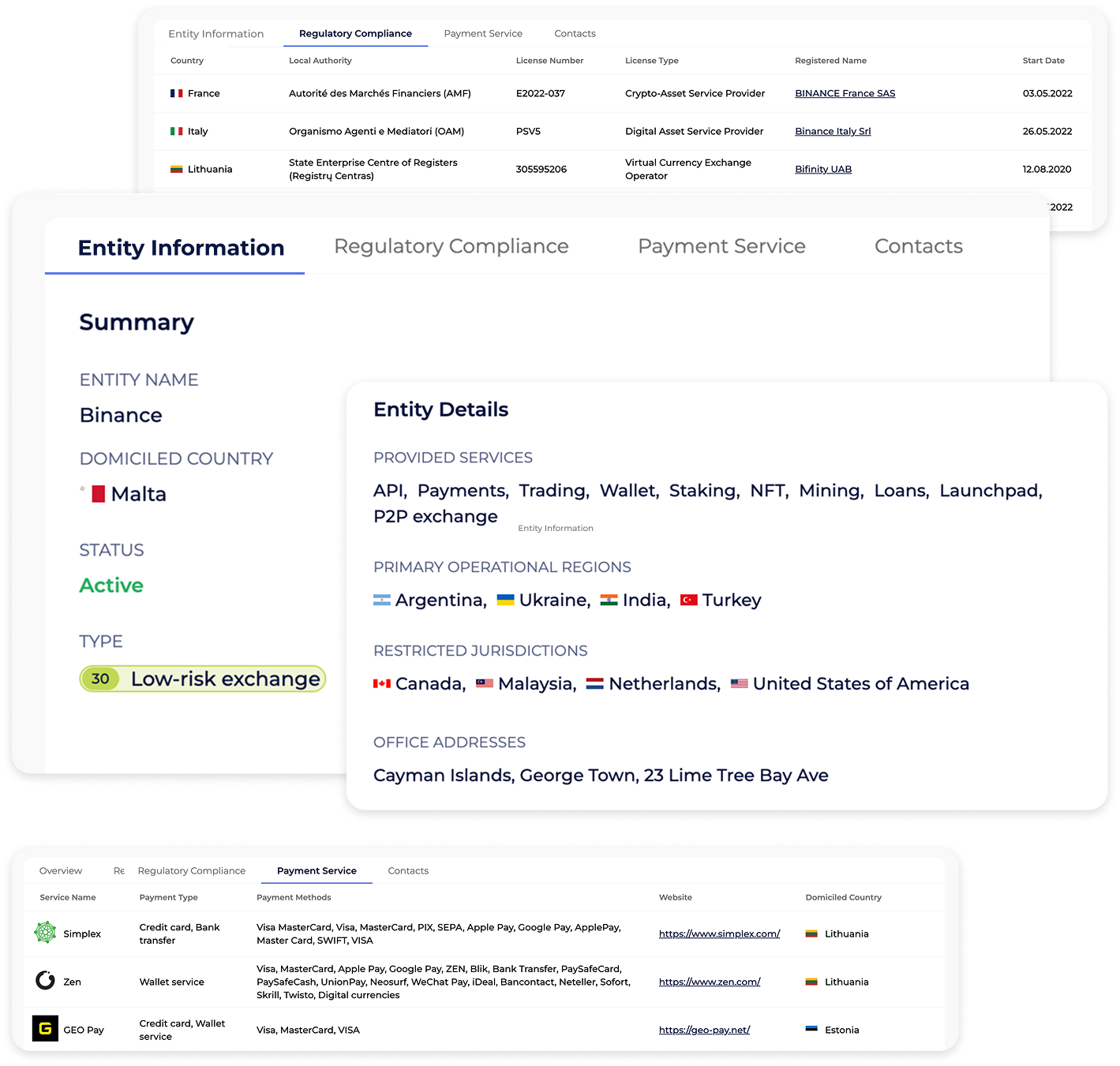

EXPLORE ENTITY PROFILES

Verify who you’re dealing with through complete profiles — and find exactly who you need using advanced filters and tags:

- Search within 92K+ entities to find licensed, emerging, or known entities.

- See UBOs and the legal entity name to confirm ownership.

- Check regions and jurisdictions to ensure compliance alignment.

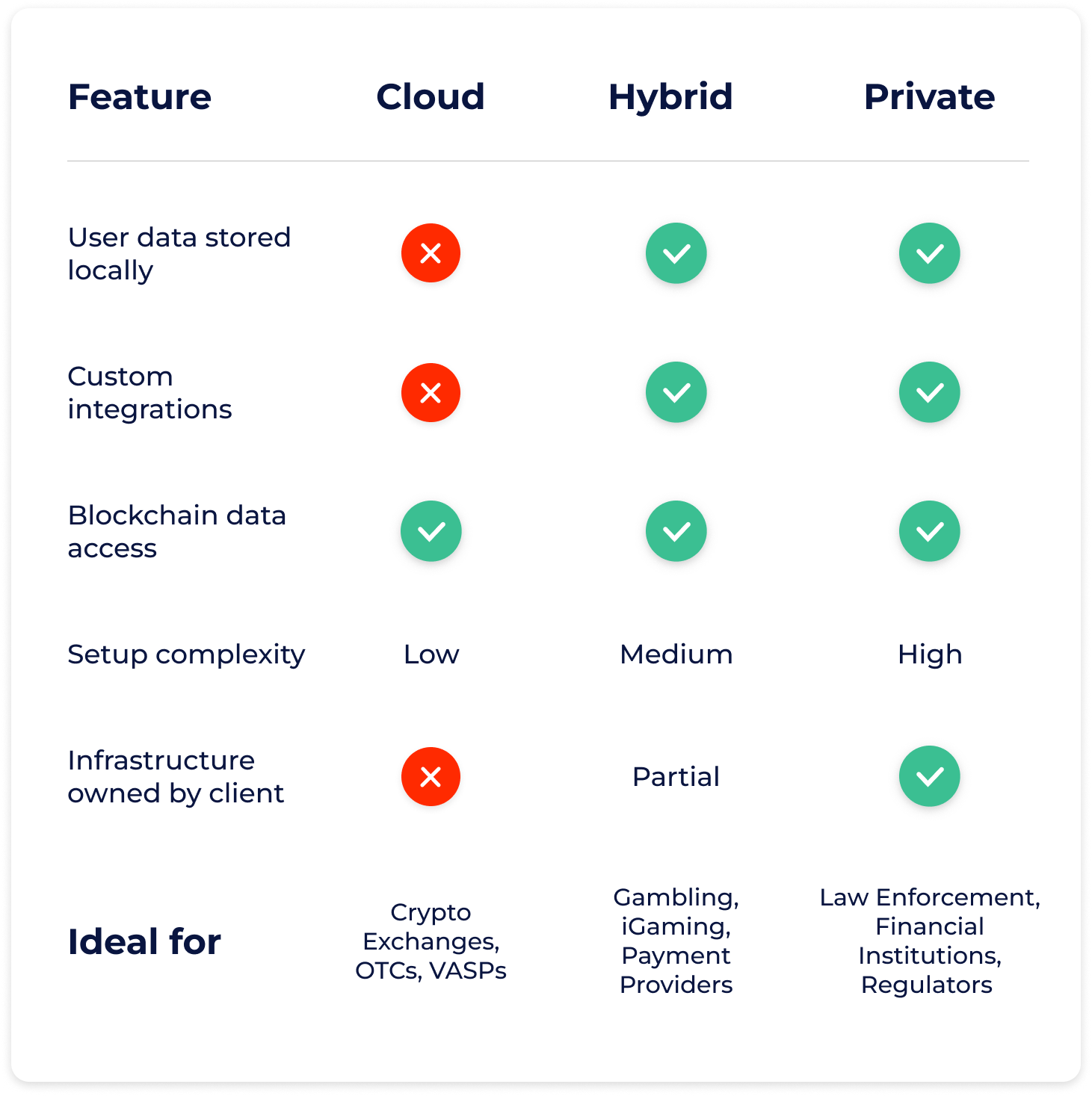

DEPLOY YOUR WAY

Choose the setup that fits your infrastructure, compliance, and security needs:

- Cloud setup for instant access and out-of-the-box readiness.

- Hybrid option for local data storage with blockchain data handled externally.

- Private setup for full control and complete on-premise operation.

FLEXIBLE FIT FOR EVERY CASE

Regulator

Conduct full-scale audits of any crypto entity in seconds — across all wallets, transactions, and counterparties. Instantly generate annual or custom-period reports to assess compliance and risk exposure.

Financial Institution

Onboard crypto-related businesses with confidence by uncovering key risks, counterparties, and fund flows. Run global audits in seconds to eliminate uncertainty and ensure informed decision-making.

Crypto Exchange

Audit counterparties, assess onboarding risks, and run self-checks in just 2 seconds. Understand your on-chain footprint and perceived risk profile to stay aligned with regulations and partner expectations.

WHY CHOOSE GLOBAL LEDGER

Entities

Access a vast, constantly updated database of licensed and emerging crypto entities worldwide.

Blockchain Coverage

Identify entity actions across Bitcoin, Ethereum, Tron, BNB, Solana, and more — covering full operation globally.

Checks Daily

Global Ledger performs 500,000 AML checks each day to ensure no threats go unnoticed.

crypto assets coverage

We support all crypto assets across every type on all supported blockchains from their very first transaction.

Response Time

Get the source of funds and risk score in just 500ms to streamline onboarding, accelerate investigations, and reduce compliance delays.

verifiable data

Access all important entity-related data like description, jurisdictions, compliance and contact info to see the full picture.

TRUSTED BY

Speed up the investigation!

"Global Ledger solution speeds up the tracing on EVM. So, it may speed up the investigation, following assets of a specific victim significantly. The tool GL created fits our needs the best in terms of analysing EVM blockchains and smart contracts, methodology applied, in terms of coverage of internal transactions of the smart contracts, and in terms of how the results are presented."

Roman BiedaHead of Investigations at Recoveris

Roman BiedaHead of Investigations at Recoveris

Compliance training that makes an impact

"Through Global Ledger’s AML training program, we are fostering a culture of compliance while empowering Panama’s legal professionals—including judges—to tackle the unique challenges posed by digital assets. "

Rodrigo IcazaDirector of the Board of The Chamber of Digital Commerce and Blockchain

Rodrigo IcazaDirector of the Board of The Chamber of Digital Commerce and Blockchain

A trusted ally in the Global AML Coalition!

"The primary purpose of the Coalition is to assemble both public and private practitioners to more effectively combat financial crime. Global Ledger has been identified as an organization whose mission aligns with this cause. "

Che SidaniusGlobal Coalition to Fight Financial Crime Vice-Chair

Che SidaniusGlobal Coalition to Fight Financial Crime Vice-Chair

Our Clients

FAQ

What is Global Ledger?

Global Ledger is a Swiss blockchain analytics company delivering fast, end-to-end AML compliance and investigation tools. Founded in 2019, we support over 2,000 digital assets and manage a database of over 700 million attributed addresses, updated daily. We perform 250,000 AML checks and monitor 30 million wallets every day. With an average response time of just 500ms and private server deployment options, Global Ledger combines speed, scale, and security.

Which blockchains does Global Ledger analyse?

Currently, the following blockchains are supported:

- Bitcoin (BTC)

- Bitcoin Satoshi Vision (BSV)

- Litecoin (LTC)

- Ethereum (ETH), including top tokens

- Tron (TRX), including top tokens

- Binance Coin (BNB)

- Polygon (MATIC)

- Arbitrum (ARB)

- Base (ETH)

- Avalanche (AVAX)

- Moonbeam (GLMR)

- Polkadot (DOT)

- Solana (SOL)

- TON.

How is the GL Score calculated?

The GL Score is a number from 0 to 100 that shows the degree of risk: low, medium, and high. Each score is represented by a corresponding color: green indicates low risk, yellow indicates medium risk, and red — high risk. The risk score is derived from the assessment of the riskiness of sources contributing to a requested address or transaction.

To calculate the score, the algorithm analyzes incoming transactions, assesses the risk of identified sources, and calculates a score on a scale from 0 to 100. This score provides an indication of the potential level of risk associated with the address or transaction based on the evaluated sources and their associated activities. Learn more about risk score calculation from our blog article.

What are your data sources?

The Global Ledger team regularly collects and constantly analyses publicly available information, open data from the top blockchains, replenishes the internal information base by conducting its own investigations, as well as data purchased from reliable vendors.

What if I need help ASAP?

Our support team stays in touch 24/7 to provide clients with the most comfortable service and experience in case of unexpected hacks or cyberattacks. Please send your request with a brief description of your case to contact@globalledger.io, and our manager will reach you shortly.